The all equity rate of return is calculated by assuming that the total cost of a property investment is financed totally by the investor without the use of any borrowed funds.

This is the same as the so called unleveraged rate of return, which in a discounted cash flow model is estimated using the cash flows before financing.

The all equity rate of return, or the unleveraged return, is different than the return on equity (leveraged return) if one or more mortgage loans are used to partially finance the acquisition of a property.

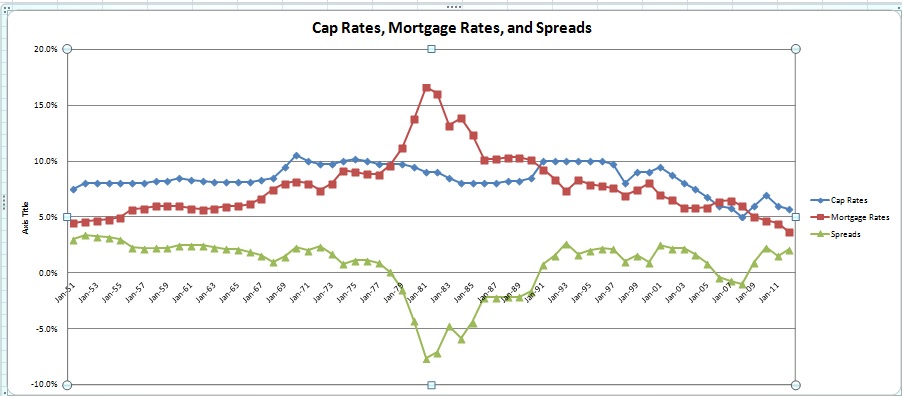

The unleveraged return is useful in evaluating whether the use of borrowed funds will increase the investor’s return on equity. The rule of thumb for carrying out such evaluation is that if the unleveraged return is higher than the cost of borrowing, then using debt to partially finance a property investment will help increase the investor’s return on equity (positive leverage). In the opposite case in which the unleveraged return is lower than the cost of borrowing, the use of debt will reduce the investor’s return on equity (negative leverage).

Comments