Debt Coverage Ratio (DCR) or Debt Service Coverage Ratio (DSCR) is a widely used ratio in the case of buy-to-let property and in general in commercial property investment analysis. The mortgage rate is a key factor in the calculation of the DCR.

This is the case because the DCR ratio is one of the two critical indicators used by bank loan officers in evaluating mortgage loan requests by property investors. When evaluating a mortgage loan request, besides the debt coverage ratio, the other critical indicator used by bank loan officers is the Loan To Value (LTV) Ratio. The loan amount given needs to satisfy both criteria.

The Debt Coverage Ratio (DCR) is the ratio of the annual net operating income (NOI) over the annual debt service, or the annual mortgage payment in the case of property. For example, if the property has an annual NOI of £100,000 and a loan with an annual mortgage payment of 80,000, then the DCR will be:

DCR = Annual NOI / Annual Debt Service =100,000/80,000 =1.25

The calculated DCR of 1.25 implies that the property net operating income is 1.25 higher than the annual payment required to service the mortgage loan. If the debt coverage ratio is smaller than 1, it indicates that the property produces insufficient income to cover both operating expenses and the mortgage payment, which is what lenders want to avoid. Within this context, lenders are usually requiring a DCR of at least 1.2, which means that property net operating income needs to be at least 1.2 times higher than the mortgage payment.

The minimum DCR required by banks varies depending on prevailing local and global economic and property market conditions. In particular, in times of economic downturn and weak property markets during which there is increased risk that the NOI of the property may decline and the DCR fall below the minimum benchmark required by the bank to approve the loan, and even below 1, banks are requiring a higher DCR, so they are protected against future declines of NOI.

If the property has more than one mortgages then the debt service used to calculate this ratio will be the sum of the annual payments due for all loans.

Required DCR and Maximum Loan

Obviously, if the property investor knows the minimum DCR acceptable by a lender and the NOI produced by the property he/she can calculate the maximum loan amount that can be obtained from the lender, based on the annual mortgage payment that is implied by these two numbers (property NOI and required DCR by lender), and which can be calculated as:

Allowable Mortgage Payment = NOI / DCR

Thus, using the example above, if the property NOI is £100,000 and the lender is not allowing a DCR lower than the 1.25, then the maximum mortgage loan a property investor can get will correspond to an annual mortgage payment of :

Maximum Loan annual payment = 100,000 / 1.25 = 80,000

The estimated maximum annual mortgage payment allowed by the minimum Debt Coverage Ratio requirement implies a different loan amount, depending on the assumptions regarding the interest rate and term of the loan that can be obtained.

Notice that eventually the loan amount that will be approved by the bank needs to satisfy not only the minimum DCR criterion but also and a maximum LTV criterion. For example,the maximum loan based on LTV ratio may not satisfy the minimum DCR requirement, as it may result in a DCR lower than the minimum required by the bank. To demonstrate this, consider the following example, which is completely hypothetical:

Minimum DCR = 1.25

Maximum LTV = 85%

NOI = £20,000

Property Value = £200,000

Interest Rate = 7%

Loan Term = 15 years

Maximum Loan Amount based on LTV = 0.85 x 200,000 = £170,000

Mortgage Payment = 18,665.09

DCR for this loan = 20,000/18,665.09 = 1.07

The estimated DCR for the loan based on the maximum allowable LTV is 1.07, which is considerably lower than the minimum DCR allowed by the bank. In this case, the maximum loan that the investor can get will be based on the minimum DCR requirement and will certainly be below £170,000.

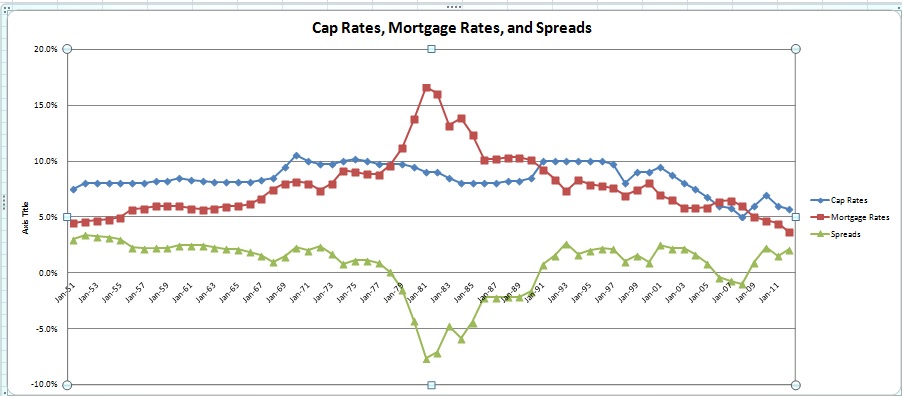

DCR and Investing for High Returns

The financing of the acquisition of a property is very important in determining the rate of return on investor equity. When the interest rates are low enough to allow for positive leverage, investors can boost significantly their return on equity by borrowing a high percentage of the acquisition price (which implies high LTV ratios). The minimum DCR requirements that prevail in the market are crucial, as they determine in many times the maximum loan amount that an investor can obtain. Obviously, the Debt Coverage Ratio criterion applies to the acquisition of income-producing property and not in the case of properties bought for owner occupancy.

Independently of the minimum Debt Coverage Ratio requirements of the lenders, it is prudent for investors acquiring income producing property to avoid borrowing amounts that will result in a DCR very close to 1, because it will make their investment more risky. If the Debt Coverage Ratio is just above 1, then with a small decline of NOI the investor will need put cash from his own pocket in order to continue paying in full the mortgage payments. In this sense, one could say that the minimum DCR works for the benefit of both the lender and the borrower, when of course it is set at reasonable levels

Comments